In many ways, the New Jersey residents now know will disappear within five years because of yawning government budget gaps, a panel of top experts said Friday.

The bipartisan group of former officials and academics presented a dark view of the state’s future that included widespread government consolidation, worker layoffs, service cuts and tax increases. Experts said that future was nearly certain to come to pass, even with a rosy economic scenario.Wow, sounds dire. Do you think maybe would should tax the people who have all the money a bit more?

Panelists, who included former state officials in Republican and Democratic administrations, suggested a widespread consolidation of municipalities and school districts. Or, better yet, county governments that supply municipal services and countywide school districts, some panelists said.

They also discussed a gasoline tax hike, a statewide property tax to fund schools, and imposition of local income or sales taxes. They mentioned an income surcharge on millionaires, but did not dwell on the oft-cited proposal. [emphasis mine]

Oh, so that's just not possible, huh? Well, what is?

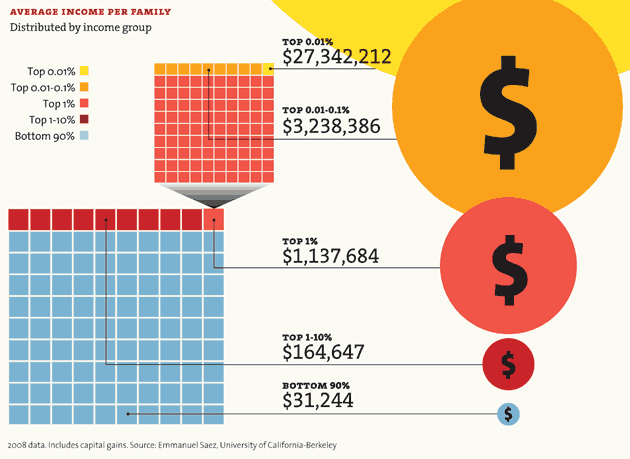

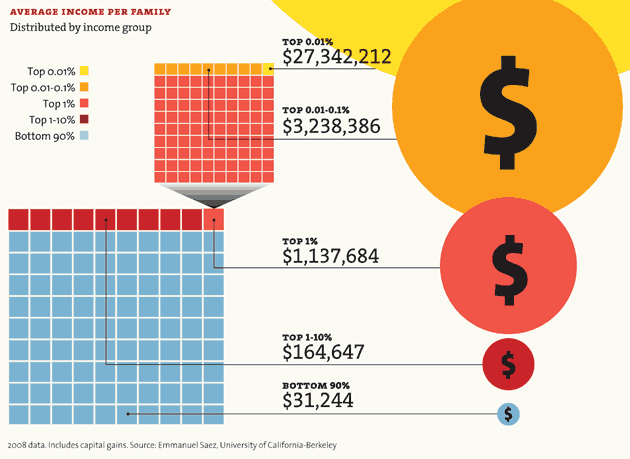

Now, we can have a conversation about where to place the tax and service burden: at the federal, state, or local level. But it is simply wrong to say we can't tax our way out of this: we most certainly could. The only reason we won't do it is because too much of our government and media are controlled by elite interests who want to keep more for the 1% and less for everyone else.

We know that New Jersey is not a relatively high-spending state. We know that New Jersey has a regressive tax structure. We know that taxing higher income earners has not led to flight. We know that NJ gave up $2.5 billion last year just by refusing to tax corporate dividends.

There is simply no need to do any of what these folks are proposing:

I refuse to buy into the nonsense that we can't afford to have good schools and decent health care for everyone and comprehensive public services and fair wages and benefits for the folks who teach kids and put out fires and have guns pointed at them. It's just not true. We as a country have more than enough money to do all these things AND still have plenty left over for successful business owners to reap the rewards of their hard work.

We just need to listen to Willie Sutton and go where the money is. It's really that simple.

The experts said local schools will have more students in each classroom, and towns will have fewer workers. Government workers who remain may have to do without the pay-grade steps they receive, often annually, and accept only modest salary increases.

And the experts said — again and again — that there would be no easy solutions.

“There is no way costs can be covered under any scenario,” said Richard F. Keevey, a former state budget director and professor at the School of Public Affairs at Rutgers University-Newark.

“You cannot raise taxes enough to cover this problem. The current level of services cannot be fulfilled, and people have to accept that,” Keevey added. “There will be significant retrenching … (But) we’re deluding ourselves if we think that regionalization and consolidation will solve this problem.” [emphasis mine]Professor, may I point something out to you?

Now, we can have a conversation about where to place the tax and service burden: at the federal, state, or local level. But it is simply wrong to say we can't tax our way out of this: we most certainly could. The only reason we won't do it is because too much of our government and media are controlled by elite interests who want to keep more for the 1% and less for everyone else.

We know that New Jersey is not a relatively high-spending state. We know that New Jersey has a regressive tax structure. We know that taxing higher income earners has not led to flight. We know that NJ gave up $2.5 billion last year just by refusing to tax corporate dividends.

There is simply no need to do any of what these folks are proposing:

Goertz also said that New Jersey could save some $1.2 billion by bringing the average number of students in the each classroom up from 12 to 15 so that fewer teachers would be needed.

“It’s the Willie Sutton principle: The money goes into the classroom,” Goetz said, alluding to famous quote attributed to Sutton about robbing banks because “that’s where the money is.”No, no, NO! The money is not in the classroom; it's HERE:

I refuse to buy into the nonsense that we can't afford to have good schools and decent health care for everyone and comprehensive public services and fair wages and benefits for the folks who teach kids and put out fires and have guns pointed at them. It's just not true. We as a country have more than enough money to do all these things AND still have plenty left over for successful business owners to reap the rewards of their hard work.

We just need to listen to Willie Sutton and go where the money is. It's really that simple.

1 comment:

Where the money goes: Corporations. Ed "Reform" corporations. OUR PUBLIC TAX money is going to FOR-PROFIT education corporations under the guise of "choice" and "reform," and what we're getting for it is fraud and lower student achievement. And they're still getting hundreds of millions of dollars of public education money, which is being taken out of public schools that do a better job of educating students. Where's the outrage??!!

http://www.nytimes.com/2011/12/13/education/online-schools-score-better-on-wall-street-than-in-classrooms.html?_r=1&ref=education

Post a Comment